Shop by Category

- Accessories

- Aspirator

- Cosmetics

- Digital Photography Systems

- Eyewear

- Footswitch/Foot Pedal

- Handpieces

- Infiltration Pump

- Laser Eyewear

- Microdermabrasion Devices

- Miscellaneous

- Portable Devices

- Skin Care Products and Make Up

- Skin Chillers

- Skin Sales Tools

- Smoke Evacuator

- Tips & Consumables

- Training & Business Tools

- User Manual/Operators Manual

- Les Encres

- Manufacturer

- Active Optical Systems

- Advalight

- Aerolase

- Aesthera

- Aesthetic Management Partners (AMP)

- Aesthetics Biomedical

- Aesthetika Lasers

- Agnes Medical

- Alma Lasers

- Artas

- Artemis

- Asclepion

- Bella Products Inc.

- BTL Aesthetics

- Buffalo Filter

- Candela

- Canfield

- Cartessa

- Cellsound Aesthetics

- Cenmade

- Cervello

- Chromogenex

- CoolTouch

- Cutera, Inc.

- Cynosure, Inc.

- Deka

- Dermasweep

- DiamondTome

- Dornier

- Dusa

- Eclipse Aesthetics

- Edge Systems

- Eleme

- Ellman

- Emage Medical

- Emvera

- EndyMed

- Energist

- Equipmed

- Erchonia

- Fisioline

- Focus Medical

- Formatk

- Fotona

- Fraxel

- HK Surgical

- HOYA ConBio

- Human Med

- Hydrafacial

- Ilooda

- Inmode Aesthetic

- Iridex

- Jeisys

- Lasering

- LaserOptek

- Laserscope / Iridex

- Lazerlenz

- Light Bioscience

- Lipo Ltd

- Lumenis

- Lutronic, Inc.

- Mattioli

- Medical Laser Technolgies

- Medicamat

- MeDioStar NEXT

- Merz

- Miramar Labs

- NeoGraft

- Noir

- Noir Laser Eyewear

- Novoxel

- Nuvolase

- Nylo Aesthetics

- Obagi Medical

- Omnilux

- Other

- Palomar Medical

- Parisian Peel

- Photo Therapeutics

- Profect Medical Technologies

- Quanta Systems

- Quantel

- RA Medical

- Radiancy

- Reveal

- RevecoMed

- Rohrer Aesthetics

- Sandstone

- Sano Laser

- Sciton, Inc.

- Sharplight

- Sincoheren

- Solta Medical

- Storz Medical

- SupraMedical

- Sybaritic, Inc

- Syneron, Inc.

- Syntech Laser

- Thermage, Inc.

- Thermi Aesthetics

- Ulthera, Inc

- Ultra Aesthetica

- Venus Concepts

- Vibraderm

- Viora

- Vivace

- Viveve

- Wontech

- Zeltiq

- Zimmer

- Procedure

- Acne Scars

- Acne Treatment

- Acoustic Radial Shockwaves

- Actinic Keratosis

- Age Spots

- Body Contouring

- Body Contouring – Diode

- Body Contouring – Hands Free

- Body Contouring – Radio Frequency

- Body Contouring – Ultrasound & Radio Frequency Combined

- Cavitation

- Cellulite Smoothing

- Cherry Angiomas

- Collagen Regeneration

- Complexion Analysis

- Dental

- Dry Eye

- Dynamic Muscle Stimulation

- Epidermal Renewal

- Erectile Dysfunction

- Face Contouring

- Face Oil Reduction

- Facial

- Facial Muscle Stimulation Treatment

- Facial Redness

- Fat & Cellulite Reduction

- Fat Grafting

- Fractional Skin Resurfacing

- Freckles

- Hair Restoration

- Hyperhidrosis

- Hyperpigmentation

- Incontinence

- Keloid Scar Treatment

- Laser Hair Removal

- Laser Hair Removal – Diode

- Laser Lipolysis

- Liposuction

- Lymphatic Massage/Drainage

- Melanin Reduction

- Melasma Removal

- Microdermabrasion

- Microneedling

- Muscle Sculpting

- Non-Invasive Hair Growth Treatment

- Non-Surgical

- Oxygen Skin Therapy

- Pain Relief

- Photodynamic Therapy

- Photofacial Rejuvenation

- Pigment Reduction

- Pigmented Lesion

- Podiatry

- Pore Minimizer – Minimize Enlarged Pores

- Port Wine Stains

- Psoriasis

- Reverse Photo-aging Damage

- RF Microneedling

- Rosacea Treatment

- Scalp Health

- Scar Correction

- Seborrheic Keratosis

- Skin Analysis

- Skin Chilling

- Skin Rejuvenation – Ablative

- Skin Rejuvenation – Non-Ablative

- Skin Rejuvenation – Sublative

- Skin Resurfacing

- Skin Tags

- Skin Tightening

- Skin Tightening – Eye Area

- Spider Veins

- Sterilize

- Stretch Marks Removal

- Sun Spots

- Surgical

- Sweat Reducer

- Tattoo Removal

- Toenail Fungus

- Transepidermal Delivery

- Ulcer/Wound Healing

- Vaginal Rejuvenation

- Vascular Lesions

- Vascular Structure

- Vein Removal

- Warts

- Wrinkle Reduction

- User Manuals

- Wavelength

- 10,600 nm (CO2)

- 1060 nm (Diode)

- 1064 nm (Diode)

- 1064 nm (Nd Yag Long Pulse)

- 1064 nm & 755 nm

- 1064 nm, 755 nm & IPL

- 1100 – 1800 nm (Infrared)

- 1319 nm (Infrared Nd Yag)

- 1320 nm (Infrared Nd Yag)

- 1400 nm (Erbium Glass)

- 1440 nm Nd Yag

- 1450 nm (Diode)

- 1470 nm

- 1500 nm (Erbium Glass)

- 1540 nm Erbium Glass

- 1550 nm Erbium Glass

- 1565nm

- 1750nm (Infrared)

- 1927 nm (Thulium)

- 2790 nm (Erbium YSGG)

- 2940 nm (Erbium Yag)

- 308 nm (Xenon Chloride)

- 532 nm (KTP)

- 532 nm / 1064 nm (KTP / Nd Yag – Q-Switched)

- 585 nm (Pulsed Dye)

- 595 nm (Pulsed Dye)

- 635 nm (Diode)

- 650-660 nm (Diode)

- 670 nm

- 680 nm (Red Diode)

- 694 nm (Ruby)

- 700 nm

- 755 nm (Alexandrite)

- 800 nm (Diode)

- 805 nm (Diode)

- 808 nm

- 810 nm (Diode)

- 850nm (Infrared)

- 900 nm (Diode)

- 980nm (Infrared Diode)

- Acoustic Wave Therapy AWT

- AFT (Advanced Fluorescence Technology)

- AMP – Active Magnetic Pulse

- CO2

- Direct Bio-Electrical Muscle Stimulation

- ElectoFusion

- EMS (Electrical Muscle Stimulation)

- HIFEM (High Intensity Focused

- IPL (Broad Spectrum)

- LED (Light Emitted Diodes)

- LIESWT – Low- Intensity Extracorporeal Shock Wave Therapy

- Multi-Wavelength

- Nitrogen Plasma

- Radio Frequency

- Radio Frequency – Bipolar

- Radio Frequency – Monopolar

- Radio Frequency – Unipolar

- Shock Wave Therapy

- TMA – Thermo-Mechanical Action

- Tripollar RF

- Ultrasound

- Ultrasound & Radio Frequency

Share this Post

2024 Update: Aesthetic Device Manufacturers Struggle Amid Economic Turmoil

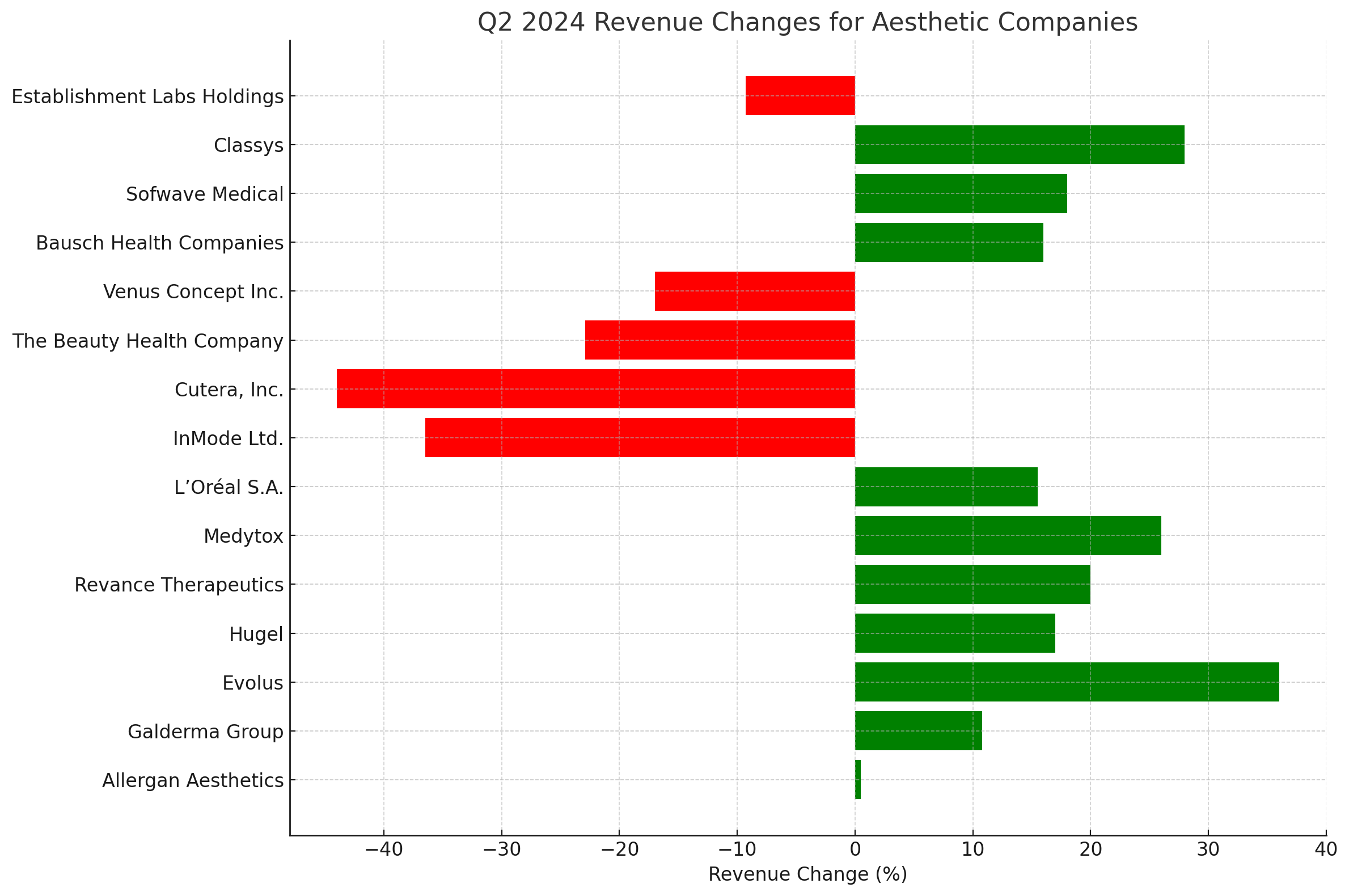

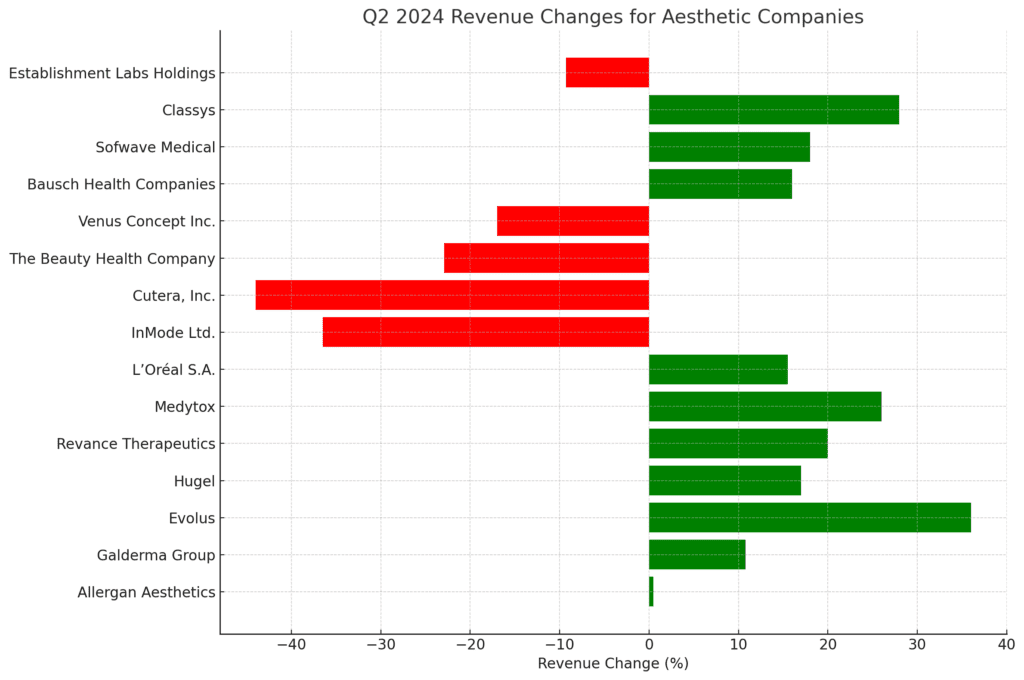

Per Medical Insight News, the second quarter of 2024 brought a turbulent landscape for the medical aesthetics industry, with companies reporting a wide range of financial outcomes. Economic uncertainties have hit the sector hard, highlighting disparities between companies that managed to navigate these challenges successfully and those that struggled.

Winners: Strategic Expansion and Innovation Pay Off

Allergan Aesthetics, a subsidiary of AbbVie, experienced a mixed quarter. While BOTOX Cosmetic sales showed a healthy growth of 6.4%, the Juvéderm line suffered a -6.8% decline. Despite these setbacks, Allergan reported an overall revenue of $1.39 billion. The disparity between BOTOX and Juvéderm’s performance underscores the importance of continuous innovation and strategic adaptation, particularly in the face of heightened competition and changing market dynamics.

Galderma Group stood out with a strong 10.8% year-over-year growth, reaching $2.2 billion in the first half of 2024. Its neurotoxins and dermal fillers performed particularly well, with sales up 16.6% and 9.8% respectively. This success can be attributed to a robust international strategy and targeted market adaptations, which helped offset challenges in the U.S. market.

Evolus and Hugel also posted impressive gains, with revenues increasing by 36% and 17% respectively. Evolus’s growth was fueled by the strong performance of its Jeuveau neurotoxin, while Hugel saw robust demand across Asia-Pacific and European markets. Hugel’s strategy of expanding its global footprint, especially in North America, positions it well for future growth.

Solta Medical, a segment of Bausch Health, reported a 16% increase in Q2 revenues, driven by the Thermage product line’s popularity in Asia-Pacific. Similarly, Sofwave Medical and Classys posted double-digit growth, demonstrating the effectiveness of strategic expansions and product innovation in a challenging market environment.

Losers: Economic Pressures and Operational Hurdles

In contrast, several companies faced significant setbacks. InMode Ltd. saw a dramatic 36.5% decline in quarterly revenues, a stark reminder of the impact that macroeconomic pressures and operational challenges can have on business. Despite these struggles, the company remains optimistic about its new platforms, Ignite and Optimus Max, as potential growth catalysts.

Cutera, Inc. reported a 44% decline in revenue, struggling particularly in North America. The company’s strategic response includes new commercial leadership and cost-cutting measures, but these efforts have yet to reverse the downward trend. Venus Concept Inc. also faced a challenging quarter, with a 17% drop in total revenue, largely driven by declining international sales and reduced system revenues.

The Beauty Health Company, known for its Hydrafacial product line, experienced a 22.9% revenue drop. This decline was attributed to lower device sales, reflecting persistent macroeconomic pressures, especially outside the U.S. The company is now focused on driving consumables growth to stabilize its performance.

Analysis: Factors Behind the Disparities

Several key factors contributed to the varied performance across the industry:

- Product Diversification and Market Adaptation: Companies like Galderma and Hugel, with diverse product portfolios and robust international strategies, managed to offset regional challenges and sustain growth. In contrast, companies heavily reliant on specific products or markets, such as Cutera and InMode, struggled more significantly.

- Macroeconomic Pressures: The broader economic environment, characterized by inflationary pressures and geopolitical uncertainties, has affected consumer spending and investment in aesthetic procedures. This impact was particularly evident in regions like China, where Allergan and others faced sluggish demand.

- Operational Challenges and Strategic Recalibrations: Several companies, including Cutera and InMode, reported operational hurdles, such as longer production times and distribution issues. Strategic recalibrations, such as cost reductions and leadership changes, are being implemented, but these measures take time to show results.

- Innovation and Product Launches: Companies with a strong pipeline of new products, like Evolus with its anticipated dermal filler launches, are better positioned to capture market share and drive future growth. In contrast, those with limited innovation are finding it harder to maintain their market positions.

The Road Ahead: Resilience Through Adaptation

The varied Q2 results underscore the resilience of the medical aesthetics industry amid economic turmoil. Companies that continue to innovate, adapt to market conditions, and expand strategically are likely to emerge stronger. For those facing challenges, strategic recalibrations and a focus on operational efficiency will be critical in navigating the current landscape.

As the industry moves forward, the ability to balance innovation with strategic agility will be key to sustaining growth and profitability in an increasingly complex market environment.

Opportunity for MedSpas: Take Advantage of the Turmoil!

MedSpas can capitalize on the current market turmoil by purchasing used medical devices at lower prices. RockBottomLasers.com offers deeply discounted prices on a variety of high-quality aesthetic devices, helping you save money without compromising on quality. Each purchase comes with a 90-day warranty, ensuring you have the support you need to keep your business running smoothly during these uncertain times. Take advantage of this opportunity to upgrade your equipment and stay competitive in the evolving aesthetics market!

Source: Medical Insight News

Author: Vin Wells

RockBottomLasers.com

800-794-1097